NBR urged to tax tobacco companies more to mend losses

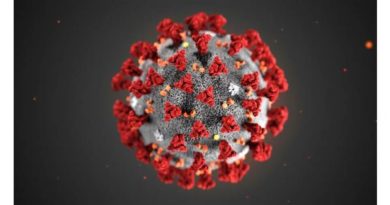

The Anti Tobacco Media Alliance (ATMA) on Sunday recommended that the National Board of Revenue should increase taxes on tobacco products and hike the prices of the products in the national budget for the upcoming fiscal year 2020-2021 to offset the losses incurred due to the coronavirus (COVID-19) outbreak.

The ATMA submitted its budget proposals for the upcoming budget to the revenue board on the day through an e-mail as per the NBR’s request under the present circumstances.

The anti-tobacco organisation also demanded that specific taxes and a two-tier pricing system should be introduced in the next budget for cigarettes.

Implementation of the proposals will bring in additional revenues worth Tk 10,000 crore for the government which may come in handy to recover from the coronavirus-related losses, it said.

It also said that implementation of the proposals would prevent six million premature deaths.

The World Health Organisation (WHO) has recently said that lungs exposed to direct and indirect tobacco smoke were at greater risks of being infected with the coronavirus.

In Bangladesh, 37.8 million adults use tobacco and 41 million people fall victim to second-hand smoke in their own homes.

The ATMA demanded that the number of price slabs should be brought down to two (low and high) from the existing four slabs.

The NBR should merge the Tk 37+ and Tk 63+ tiers under the low tier and impose 50 per cent supplementary duty and Tk 10 as specific tax on the minimum retail price proposed to be set at Tk 65 for 10 sticks.

The revenue board should also merge the Tk 93+ and Tk 123+ tiers under the premium tier and the minimum retail price for 10 sticks should be set at Tk 125.

A supplementary duty of 50 per cent and specific tax of Tk 19 should be added to the premium tier.

The organisation also demanded the elimination of the existing price distinction between filter and non‑filter bidis. Both the prices and taxes on bidis and smokeless tobacco products should also be raised.

In addition to the current proposals, the anti-tobacco body urged that all tobacco products should continue to be subject to 15-per cent value-added tax. (Source: New Age)